Revaluation: Difference between revisions

Wolfganguhr (talk | contribs) |

Wolfganguhr (talk | contribs) |

||

| Line 50: | Line 50: | ||

# Account ... | # Account ... | ||

I realy do not understand what do to because I cannot change the values of one of the accounts 6000, 6001 or 9000 because the values are wrong. Which accounts do I have to change in which way? | I realy do not understand what do to because I cannot change the values of one of the accounts 6000, 6001 or 9000 because the values are wrong. Which accounts do I have to change in which way? This is a blocker. Nothing will go on untils someone explains me that! | ||

Revision as of 10:01, 4 February 2011

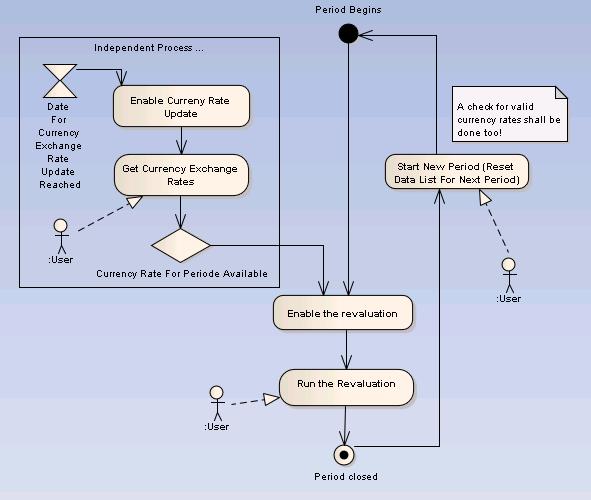

Revaluation is a peridical process in the accounting processes if the ledger holds up a set of foreign currency accounts. The standard case for such a period is a month but this can be changed.

In order to understand the revaluation resp. in order to be able to run a revaluation process, you have to unterstand that you need at least 3 processes to be able to run it.

Revaluation outside - the other Processes

The foreign currency update

The first extern process is the update of the currency exchange rates. This process may have the same period as the revaluation process (one month) but in normal cases this process is totally desynchronized. The accounting interval may be an interval in the past and for example the January the 1st 2011 may be the date to define the values which are actual for the following month and the accounting interval may be a month in 2009. So this process is running parallel but on it’s own rules.

The update process can be done more ore less automatically. A set of different techniques are possible.

- It may be possible that one ore more different public information server on the web are good for the job.

- It may be a good idea for the OM-International to offer an update service for all those national offices

- It can be done manually by a user.

In the development phase for the revaluation a static test data set will be sufficient. But you can not use the revaluation without at least one running update processes.

The Period Reset

After all jobs in an accounting period have been done, the accounting period will be closed and the work will be continued using the next period. Such a reset must exist in some rudimentary form.

The Revaluation

There are two reasons for a revaluation.

- A foreigen currency transaction has been accounted and the transaction sheets are out of balance.

- The foreign currency exchange rates changes and this automaticaly disbalances the accounts.

A normal transaction

The best way is to get a look onto a voucher I've got by changing some money. I beg your pardon for the bad quality but is was meant to be for private use only. That was no business money.

This voucher tells us: I have changed € 30.00 into £ 21.82. The exchange rate was 1.3752 and there was a fee of £ 2.50. I'm comming form Germany and so let us assume that the base currency of my accounting is €.

Furthermore the exchange rate on the voucher was 1.3752 but the internal exchange rate may be 1.300. So we geht the account list:

- Account 6000 Petty Cash € - Credit: € 30.00

- Account 6001 Petty Cash £ - Debit: £ 21.82

- Account 6001 Petty Cash £ - Credit: £ 2.50

- Account 9000 Provisions € - Debit: TransactionValueIn€Of(£ 2.50, Rate=1.300)

Now we have to to a balancing transaction and an realy need an example. Someone who knows what do to has to full fill the list ...

- Account ...

- Account ...

I realy do not understand what do to because I cannot change the values of one of the accounts 6000, 6001 or 9000 because the values are wrong. Which accounts do I have to change in which way? This is a blocker. Nothing will go on untils someone explains me that!