Periodic End Calculations

In Accounting Systems the term "Periodic End" either means a period like a month and or a period like a year. In "older systems" you also know the period of 10 years (deletion of old data) but actually we speak about the month and the year.

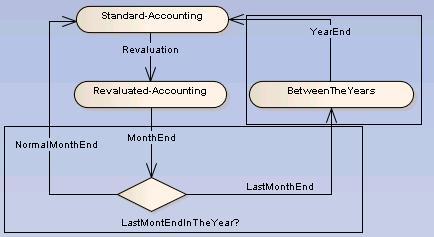

Today this two periods split the state of the accounting system into three different types.

Actually we speak about

- the standard accounting

- standard gift batches are allowed

- standard batches are allowed

- foreign currencies are allowed

- the revaluated accounting

- standard gift batches are allowed

- standard batches are allowed

- foreign currencies are allowed

- the year end accounting

- actually unknown ...

So:

- the month end only can change to the status "standard accounting" if it is a month of the same year or to "year end accounting" if the last month of the year has been closed.

- the year end has been done to set the value to the next year.

Info: The number of months can be lager than 12.

Month End

The month end will run the tests

- If a revaluation is done (i.e if the status "revaluated accounting" ist activated) (critical)

- If the system is not in the "year end accounting" (critical)

- If there are unposted batches (critical)

- If there are unposted gift batches (critical)

- If there are non zeroed suspense accounts (critical)

- If there are zeroed suspense accounts the user gets an informal message

The critical messages will disconnect any possibilities to continue.

The month end will include:

- Calculation of the admin fees (to be done)

- Calculation of the ICH fees (to be done)

- switch to the next month or to the "year end accounting" state

Year End

The Reallocation

Inside the routines for the year end we have the Account Reallocation. Shortly spoken it is the movement from the account values of the type Income and Expense to Equity values. Se we've go to the complete list of income- and expense accounts, iterate the list of cost centers used on that account and account them to a equity account.

The ICH-Account (in petra this are the accounts 85*) are of type Assets but they have to be reallocated to.

The iteration process guarantees that every account and every cost centre has been considered. In any valid combination of a cost centre code and account code, there exist a predefinded accounting target.

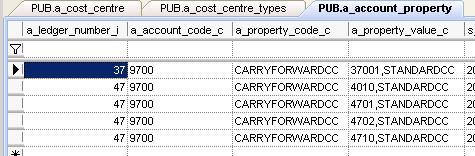

The standard target account in petra is the account 9700 which is defined in the a_account_property table and the column a_account_code_c.

The following reallocation rules have been detected:

Target Account Codes for the Reallocation

- If a_ledger.a_ilt_account_flag_l has been set, the target account allways is the account ICH_ACCT (Account Code 8500) regardless of the following rules (a_ledger-values are valid for all accounts in the ledger!).

- Otherwise the default value for the target account will be EARNINGS-BF-ACCT (Account Code 9700)

- The default account value can be overwritten to an other value by an cost centre property which is stored in a_account_property.

Target Cost Centre Codes for the Reallocation

- If a_ledger.a_ilt_account_flag_l has been set, the target cost centre of glm shall be used regardless of the following rules.

- If a_ledger.a_branch_processing_l has been set, the target cost centre of glm shall be used regardless of the following rules.

- Otherwise the default value for the target cost centre will be STANDARD-COST-CENTRE (this is the ledger number followed by "00")

- The default cost centre value can be overwritten to an other value by an cost centre property which is stored in a_account_property.

Here instead of STANDARDCC the key SAMECC shall be placed.