Revaluation: Difference between revisions

Wolfganguhr (talk | contribs) |

Wolfganguhr (talk | contribs) |

||

| Line 96: | Line 96: | ||

# Revaluation Loss - € 0.03 | # Revaluation Loss - € 0.03 | ||

=== Relevance of different cost centers === | |||

Even if the account values are growing the revaluation is only a cent moving machine. It’s main task is to hold the different accounting reports in balance. The number of cents increase only by an increasing number of transactions in foreign currencies, by increasing currency rate exchanges. And even if there is more than one transaction a day, the values will be added using six digits and only the sum is rounded down to two digits. This implicitly means that there are joined to one transaction. So only one common cost center is required. | |||

=== Differences of the two types of revaluation === | === Differences of the two types of revaluation === | ||

Revision as of 05:25, 6 February 2011

Revaluation is a peridical process in the accounting processes if the ledger holds up a set of foreign currency accounts. The standard case for such a period is a month but this can be changed.

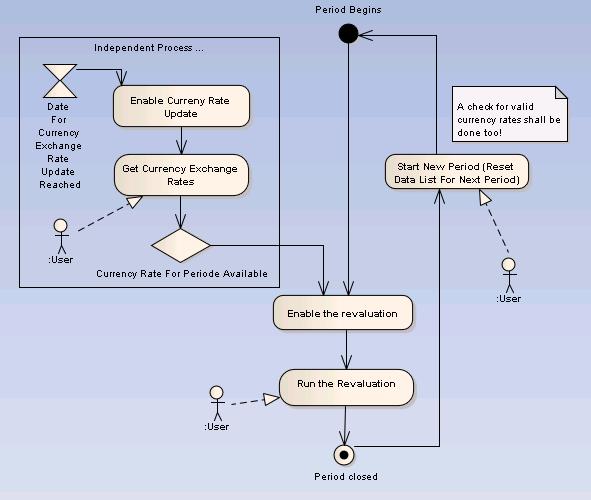

In order to understand the revaluation resp. in order to be able to run a revaluation process, you have to unterstand that you need at least 3 processes to be able to run it.

Revaluation outside - the other Processes

The foreign currency update

The first extern process is the update of the currency exchange rates. This process may have the same period as the revaluation process (one month) but in normal cases this process is totally desynchronized. The accounting interval may be an interval in the past and for example the January the 1st 2011 may be the date to define the values which are actual for the following month and the accounting interval may be a month in 2009. So this process is running parallel but on it’s own rules.

The update process can be done more ore less automatically. A set of different techniques are possible.

- It may be possible that one ore more different public information server on the web are good for the job.

- It may be a good idea for the OM-International to offer an update service for all those national offices

- It can be done manually by a user.

In the development phase for the revaluation a static test data set will be sufficient. But you can not use the revaluation without at least one running update processes.

The Period Reset

After all jobs in an accounting period have been done, the accounting period will be closed and the work will be continued using the next period. Such a reset must exist in some rudimentary form.

The Revaluation

There are two reasons for a revaluation.

- A foreigen currency transaction has been accounted and the transaction sheets are out of balance.

- The foreign currency exchange rates changes and this automaticaly disbalances the accounts.

Revaluation situations

A normal transaction

The best way is to get a look onto a voucher I've got by changing some money. I beg your pardon for the bad quality but is was meant to be for private use only. That was no business money.

This voucher tells us: I have changed € 30.00 into £ 21.82. The exchange rate was 1.3752 and there was a fee of £ 2.50. I'm comming form Germany and so let us assume that the base currency of my accounting is €.

Furthermore the exchange rate on the voucher was 1.3752 but the internal exchange rate may be 1.300. So we geht the account list:

For the exchange itself:

- Account 6000 Petty Cash € - Credit: € 30.00

- Account 6001 Petty Cash £ - Debit: £ 21.82

For paying the provision:

- Account 6001 Petty Cash £ - Credit: £ 2.50

- Account 9000 Provisions € - Debit: TransactionValueIn€Of

The exchange rate on the voucher pointed out an exchange rate of 1.3752. This value shall not be used here for two reasons:

- The base currency of the accounting system (I’m living in Germany) is the Euro and I have Changed from Euro to pound. So I need the inverse exchange rate 1/1.3752 » 0.7272.

- But even this value is the wrong exchange rate because only one exchange rate for all accounts inside a time period is allowed. So let us assume, that we have an actual exchange rate of 0.7270 from Euro to British pound.

Let us divide £ 21.82 by our internal value and we find a six decimal rounded value of 30.013755. Because actually it is the only value inside one Journal, then we have to round the sum up do two decimals which means that £ 21.82 will represent a base currency value of € 30.01.

But in the next step we have to pay £ 2.50 for the service which means a base currency value of € 3.438790. For the account number 9000 it is the only transaction of the journal and so the total value is € 3.44. So let us complete the accounting list.

- Account 6001 Petty Cash £ - Credit: £ 2.50

- Account 9000 Provisions € - Debit: € 3.44

Let us go round the transactions

- we have spend (credit-account) € 30.00. -> + € 30.00

- we have got (debit-account) £ 21.82 -> -30.01

- we have spend £ 2.50 - > + € 3.44

- we have accounted a provision -> - € 3.44

This makes a difference of 1 cent. Let us assume that there is a set of accounts – “4000 Transaction Loss” and “4001 Transaction Win” we get a complete list of transactions ...

- Account 6000 Petty Cash € - Credit: € 30.00

- Account 6001 Petty Cash £ - Debit: £ 21.82

- Account 6001 Petty Cash £ - Credit: £ 2.50

- Account 9000 Provisions € - Debit: € 3.44

- Account 4001 Transaction Win € - Credit: € 0.01

This “Transaction Win” brings a Journal into balance and enables the posting of the journal. So a button like "Create Currency balance transaction" would be a good idea.

TODO:

- We have to find realistic or typical values for the account numbers.

- We have to check if debit und credit is always on the correct side.

- Two accounts (Loss and Win) or one account (accounting on debit and credit side).

Changes of the currency rate(s)

Let us assume that we have the accounts “5000 Revaluation Win” and 5001 “Revaluation Loss”. And let us assume that we have a Account 6001 Petty Cash which hold a value of £ 50.00. furthermore we have an actual currency exchange rate of 0.7270 and this value shall be changed to 0.7273.

Based on the exchange rate of 0.7270 we find a representative value of the £ 50.00 of € 68,78 and based on the exchange rate of 0.7273 we find € 68,75.

So we have to account

- Revaluation Loss - € 0.03

Relevance of different cost centers

Even if the account values are growing the revaluation is only a cent moving machine. It’s main task is to hold the different accounting reports in balance. The number of cents increase only by an increasing number of transactions in foreign currencies, by increasing currency rate exchanges. And even if there is more than one transaction a day, the values will be added using six digits and only the sum is rounded down to two digits. This implicitly means that there are joined to one transaction. So only one common cost center is required.

Differences of the two types of revaluation

The main difference is: If you account a voucher you already have defined a batch and a journal and you only have to find the correct balancing transactions to be able to post a balanced batch. If you change the rates, then the batch and the journal will be created too.

So in the normal cases

- Accounting revaluation is a menue point (a one click command) for an existing journal which holds foreign currencies

- Ledger revaluation a full automatic process which is to be done inside the “Close accounting period”-process. The exchange rates are stored in the databases and the account values too. Only a revaluation configuration shall be developed.

The Ledger-Revaluation configuration shall handle the following information:

- Select the correct revaluation accounts and cost centers (which are implicitly valid for the accounting revaluation).

- Decide weather the revaluation has to be done as the last action of a period or as the first action.

May be that somewhere in the middle is an option but then someone has to start it manually and independently of the “Closing the actual period” process.